01 It is natural that there are ups and downs

Value may be late, but it will not be absent forever. In the long run, the stock market is a weighing machine for value, and it is right for stock prices to fluctuate around value, while short-term prices. Value often deviates. When the stock price is ahead of value, it needs to be adjusted. When share prices lag behind the company's value, it's almost time to rebound.

02 No one can predict the rise and fall of the market

If the market could be predicted, the economist Fisher should not have bottomed out during the bursting of the US stock bubble in 1929 and lost millions of dollars and was destitute. Financial tycoon Soros will no longer short the Japanese stock market in 1987 and end in a fiasco. Warren Buffett should not buy the big four American airlines from the bottom in February 2020 and liquidate all of them soon. You see, the masters are not bulletproof. Are they in a better mood?

03 There is a mountain in front of me, In the long run, it's just a hurdle

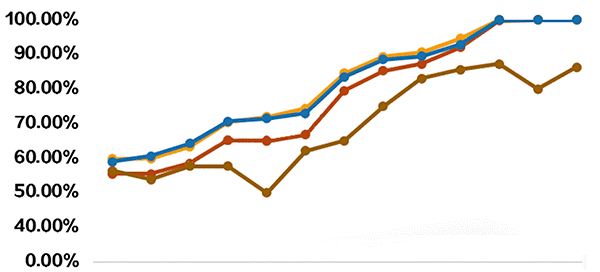

In the long run, the market is rational and will give sufficient pricing to assets, but the participants in the market are people, which are easily affected by emotions and group behavior, and often show extremes. The irrational state is more depressed when pessimistic and more blind when optimistic. The limit of thousands of shares fell in 2015, the negative returns on global assets in 2018, and the panic caused by the Covid-19 at the beginning of 2020 all had a great impact on the market at that time.

Looking back, is the market depressed or rebounding strongly? The answer is self-evident, so in the long run, what is there to worry about?

04 Investment requirements help professionals

We probably don't want to compete with athletes, nor do we compare our cooking skills with Michelin chefs, let alone compete with surgeons about the level of surgery.

How can we be so confident when it comes to investing?

Before we start investing and managing money, we can try to ask ourselves the following questions:

- Do you have the necessary expertise for investment?

- Do you have enough time and energy?

- Is there enough experience to accumulate?

- Do you have the necessary emotion control and management ability for investors?

If all the above answers are no, consult a professional honestly.

05 Investment only use long-term disposable spare money

Investing with spare money has the following advantages:

- When the bull market returns are maximized: spare money is not in a hurry, bear market buying, bull market selling, is the choice to maximize earnings.

- Extreme market, spare money will not be forced to cut meat: the stock market, 10% of the time, bring 90% of the income. We don't know when the bull market will come, but if it's not for spare money, you may not be able to wait for the bull market.

- In the face of ups and downs, the state of mind is more calm: the stock market is characterized by ups and downs. In case of skyrocketing and plummeting, if it is money that needs to be used at any time, can your heart stand it? The mentality collapses, and all the investment strategies are empty talk.

06 Risk and return are two sides of the coinThere are gains and losses. As far as investment is concerned, what we get is the possible asset appreciation, and what we lose is the current liquidity and opportunity cost of the asset. There must be something in return for what you give, and if you don't pay, there will be no report. Risk and income go hand in hand, only income without risk is not realistic.

07 Have a reasonable expectation of the return on investment

A reasonable earnings expectation, or lowering earnings expectations, will not make us lose our mindset in the face of adjustment.

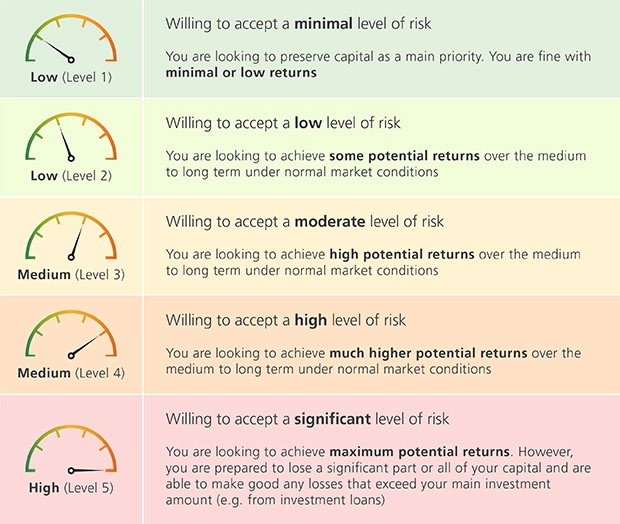

08 Choose the product that suits your affordability

Some people are born with an adventurous spirit, while others are relatively more conservative. For investors who pursue high risk and high return, low volatility investment products can not meet their requirements. Conversely, for investors with limited risk tolerance, it will be painful to take too much risk. What is suitable is the best.

Risk Warning: The above content is for reference only, and does not represent JRFX’s position. JRFX does not assume any form of loss caused by any trading carried out in accordance with this article. Please consult your financial planner for your investment portfolios and manage your own risk.

JRFX is an online CFD broker providing more than 50 products for Forex, metals and commodities. Open a trading account within a minute. Deposit 100USD and download our MT4 trading platform now!

|

|

|

|

Views: 1648

Likes: 0