The full name of the NFP is Nonfarm

Payroll, which is the Nonfarm data that people often talk about in foreign

exchange transactions. For the foreign exchange market, Nonfarm data is the

highlight of every month that must be paid attention to. The economic data in

the United States every month is overwhelming. Among them, Nonfarm employment

data is the most interesting. Nonfarm employment data is an employment

indicator of the U.S. Bureau of Labor Statistics. It fully reflects the

creation, loss, working time and salary of employment opportunities.

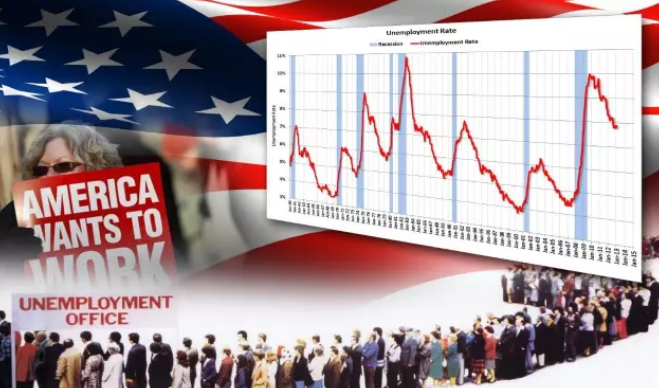

Through Nonfarm data, foreign exchange

traders can have a clearer understanding of the expansion or contraction of the

US economy. The increase in general employment means that the company is hiring

and expanding, and the hired people will have money to consume to promote

economic growth, and the decrease in employment is the opposite. At the same

time, Nonfarm data also affects the Fed's decision on interest rates to a

certain extent. The suppression of the market in the past has focused on the

trend of interest rates that may appear in the future. The disappointing data

indicates that the Fed may cut interest rates to boost growth. If employment

growth is higher than expected, the Fed may raise interest rates to ease the

situation. economic overheat. In addition, as the largest economy in the United

States, its currency is the currency of the global reserve. Therefore, many

economies link its currency value to the reserve currency, and many commodities

are also priced in accordance with the reserve currency.

The impact of Nonfarm data, foreign

exchange traders often speculate on these Nonfarm data. Like other indicators,

the difference between actual Nonfarm data and expected data determines the

overall impact on the foreign exchange market, and the data is often released

on the same day. Will cause volatility in the foreign exchange market. The

assets most affected by Nonfarm data include the U.S. dollar, the stock market

and gold. Prior to the release of the data, the foreign exchange market reacted

very quickly and was unstable most of the time. Short-term market trends showed

that there was a strong correlation between Nonfarm employment data and the

strengthening of the U.S. dollar. The foreign exchange market attaches great

importance to the comparison between the number of Nonfarm employment and

expectations. If the actual data is lower than the economist’s estimate,

foreign exchange investors will sell the U.S. dollars on hand, and vice versa.

When the data is consistent with the economist's forecast, the foreign exchange

market will turn to the attempted sub-data in the report.

Risk Warning: The above content is for reference only, and does not represent JRFX’s position. JRFX does not assume any form of loss caused by any trading carried out in accordance with this article. Please consult your financial planner for your investment portfolios and manage your own risk.

JRFX is an online CFD broker providing more than 50 products for Forex, metals and commodities. Open a trading account within a minute. Deposit 100USD and download our MT4 trading platform now! We have unprecedented promotion program!

|

|

|

|

Views: 1648

Likes: 0