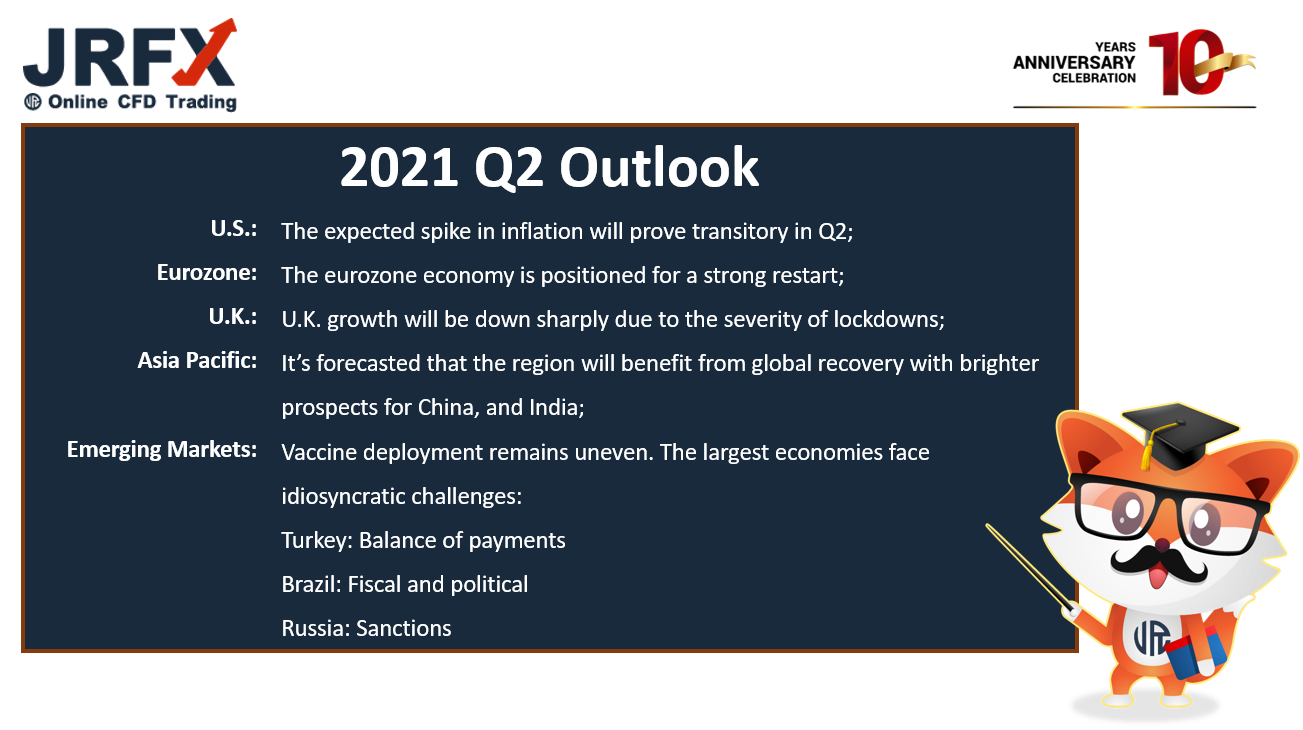

We forecast a strong global recovery in 2021 amid significant fiscal support, accommodative monetary policy, diminishing lockdowns, and accelerating vaccinations. Markets are priced for positive vaccine news, and while positivity is our base case, any disappointments in vaccine supply, distribution or adoption — or increased risk from virus variants — could stoke volatility.

Predicting the future is hard. In this uncertain environment, we seek to maintain portfolio flexibility and liquidity to be able to respond to events as they unfold.

Our Analyst team identifies and discusses some of the risks and opportunities, that are facing local governments and organizations.

US

The US was able to avert economic disaster in 2020 due to a significant fiscal and monetary policy response, i.e. the $1.9 trillion stimulus in addition to the $900 billion package approved in December. Nevertheless, a “K” shaped recovery is underway where industries and households most vulnerable to the pandemic are still in need of assistance to prevent long-term economic scarring. The trajectory for recovery is dependent on a supportive policy environment and a likely step change in the level of technological know-how among firms and households which could make way for a productivity burst as the post-pandemic economy. Despite the improved outlook, we see jobs as a lingering weak point in the recovery, with unemployment, adjusted for labor force composition, reaching its pre-crisis rate only by the second half of 2023. We think the expected spike in inflation in second-quarter 2021 will prove transitory. Still-high unemployment and low inflation will keep the Fed on hold until late 2023.

DXY - One of the big drivers in markets last year was the US dollar and this could be set for a revival. The bounce at 90 is extending and could move higher in Q2. That could see a correction in commodities. The dollar index could make its next move to 94.00 if the recent selling is temporary.

EUROZONE

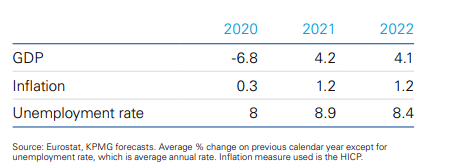

As of mid-March, less than 10% of the population in France, Germany, Italy and Spain had received at least one dose of vaccine. This compares to nearly 25% in the United States and 40% in the United Kingdom. Infection rates are rising in Europe and new lockdowns have been imposed in several countries. After a slow start, however, the vaccine rollout is gaining pace and Europe should be on track for economic reopening by Q3. The post-lockdown recovery is likely to be extremely strong and GDP should bounce back by around 5% this year following last year’s near 7% decline.

Stricter social distancing restrictions put in place to combat rising infection numbers have set back recovery. Despite generous fiscal and monetary support, the path to recovery will continue to diverge across the Eurozone. However, the pace of fiscal spending will be less supportive of growth than in the U.S. this year, while implementation of the EU recovery plan is likely to be felt mostly from 2022 (Table 1: Eurozone/GDP).

We expect the MSCI EMU Index, which reflects the European Economic and Monetary Union, should outperform the S&P 500 in 2021.

UK

The economy managed to avoid a contraction in the fourth quarter of 2020 despite a lockdown taking place during part of the quarter. However, growth momentum eased in December with the economy contracting by 9.9% overall in 2020.

The fast vaccine rollout should help the UK achieve a large rebound from last year’s 9.9% GDP decline. Accelerated vaccine roll-out program should support a solid recovery in second half of 2021.

Brexit-related frictions and limited agreement on Services trade with the EU will dampen recovery. The impact of Brexit on supply chains is also likely to push up consumer prices. However, inflation is expected to remain below the Bank of England’s 2% target by next year, allowing for a longer period of low interest rates to support the economic recovery. The FTSE 100 Index has been the worst-performing regional equity market in recent years, but the outlook is improving in line with the economy.

GBPUSD

Sterling also has upside on a 12-month horizon, although at 1.39 to the U.S. dollar (USD) it is now close to the OECD’s measure of purchasing power parity fair value. Sterling has appreciated by 20% against the USD since the depths of the pandemic last year. It can make further gains as the UK economic outlook brightens but valuation will be a headwind.

ASIA PACIFIC

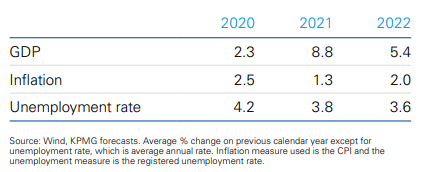

The region will benefit from a stronger global recovery. While the vaccine rollout may lag other regions, we expect enough progress to lift consumer spending, the weak spot in the recovery so far, later in 2021. We forecast China to grow by 8% in 2021 (up from 7%) on stronger trade and real estate activity(Table 2: China/GDP). U.S.-China tensions continue to linger in the background. Our base case, however, is that there will not be further escalation from the new U.S. administration during these early stages of the economic recovery.

We raised India's growth to 11% from 10% (in fiscal 2021), due to faster-than-expected re-opening and fiscal stimulus. We kept Japan at 2.7% in 2021 but see upside risks from exports.

EMERGING MARKETS

We see generally better macroeconomic outcomes this year as the pattern of strong industrial output and exports, and weak services persists. Vaccine deployment remains uneven. We forecast GDP growth for our EM-14 group (excluding China and India) of 4.4% in 2021, 20 basis points above our previous forecast.

On emerging markets (EM), in addition to EM external positions, we expect to have select EM local positioning where appropriate, with careful scaling given liquidity considerations and a medium-term orientation in these markets.

On currency positioning, we expect to maintain a modest U.S. dollar underweight versus the basket of G-10 currencies and select EM currency exposures in our more globally orientated portfolios. This reflects valuations and the potential for currencies of countries more exposed to the global economic cycle, and hence likely to benefit during the recovery period we envisage, to outperform versus the U.S. dollar.

|

|

|

|

Views: 76259

Likes: 0