Asian equities look set to retreat after U.S. stocks closed off all-time peaks as a drop in Coinbase and technology shares overshadowed strong bank earnings. Futures dipped in Hong Kong and Australia and were steady in Japan. Treasuries slipped in U.S. trade and the dollar extended losses into a third session. Bitcoin touched a record of $64,870 before easing. Oil jumped above $63 a barrel as shrinking crude stockpiles in the U.S. supported hopes for a global demand recovery.

Cryptocurrency exchange Coinbase Global soared above a $112 billion valuation in its Nasdaq trading debut Wednesday, then slipped back below its opening price as Bitcoin fell from record highs and tech stocks fell across the board. The massive valuation dwarfs more traditional financial firms — including Nasdaq itself. Coinbase shares closed at $328.28, down 14% from the opening price after earlier climbing as high as $429.54. For some employees, the startup has brought a lightning fast rise to vast wealth. Former Google executive Surojit Chatterjee joined 15 months ago, a move worth more than $700 million.

Asia-based hedge fund managers including Sylebra Capital Ltd. and Aspex Management are joining the SPAC boom, seeking large stakes in companies that could emerge as the next Grab Holdings Inc.

Recent deals include:

1. Aspex, Dymon and Snow Lake are among anchor investors that have pre-committed a combined $110 million in PIPE funding for a Gaw Capital SPAC, which is targetting a technology company.

2. Aspex and fellow Hong Kong-based alternative investment manager PAG have committed $60 million in a private round that will help billionaire property scion Adrian Cheng’s SPAC finance an acquisition

3. Aspex, with more than $3 billion under management, pre-committed a combined $80 million with another anchor investor to help former Goldman Sachs Group Inc. rainmaker Fred Hu’s SPAC complete a merger in the consumer space

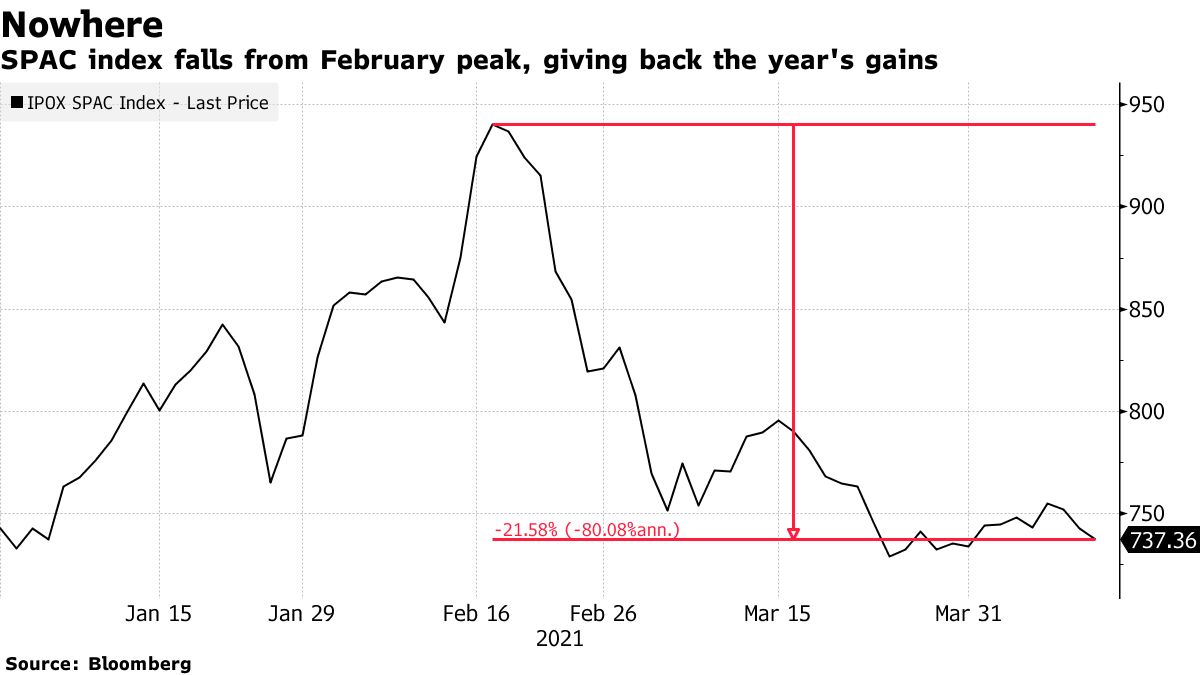

The funds are committing more money even as U.S. regulators clamp down on special purpose acquisition companies that have raised $100 billion this year, topping last year’s record. The craze has prompted the U.S. Securities and Exchange Commission to issue new guidance on accounting for SPAC warrants, and warned that the vehicles aren’t a way around securities rules.

|

|

|

|

Views: 76498

Likes: 0