In early trading on Wednesday, WTI oil prices hovered around $81.60, and the market remained cautious ahead of the release of U.S. inflation data and the minutes of the Federal Reserve meeting.

In the previous session (11th), crude oil prices rebounded as people increasingly expected the Federal Reserve's hawkish stance to soften further, while OPEC+'s recent measures to cut supply also provided support.

Meanwhile, U.S. crude inventories unexpectedly rose by 300,000 barrels in the week to April 7, data from the American Petroleum Institute (API) showed, partly due to the release of 1.6 million barrels from the Strategic Petroleum Reserve.

Tonight, the U.S. Energy Information Administration (EIA) will release official inventory data, which is expected to provide further clarity on the inventory situation in the world's largest oil consumer, with analysts forecasting a draw of 583,000 barrels.

Inventories have continued to draw down over the past two weeks as improving weather conditions across the United States spurred fuel demand. At the same time, the prospect of tighter supply, especially OPEC+ production cuts, keeps the crude oil market optimistic.

The main market focus is on the U.S. consumer price index (CPI) data due tonight, with expectations for a slight decline in inflation. While inflation remains well above the Fed's target, the market is increasingly betting that the central bank is getting closer to a pause in rate hikes.

On the other hand, the market remains concerned about further weakening of oil demand, especially due to slowing economic growth. Data from China on Tuesday showed that CPI fell far short of expectations in March.

Crude oil market highlights this week also include monthly oil market reports from OPEC and the International Energy Agency (IEA). Both groups had previously expected China's recovery to push oil demand to an all-time high this year.

However, the first monthly report released by the U.S. Energy Information Administration (EIA) lowered the growth rate of global crude oil demand in 2023 by 40,000 barrels per day to 1.44 million barrels per day, but raised the forecast for WTI crude oil prices in 2023 to $79.24 per barrel , previously expected to be 77.1 US dollars / barrel.

Despite lower demand expectations, the US Energy Information Administration still raised prices mainly due to reduced supply. The agency expects OPEC production to fall by 500,000 bpd for the remainder of 2023, and Russian fuel output to fall by 400,000 bpd this year.

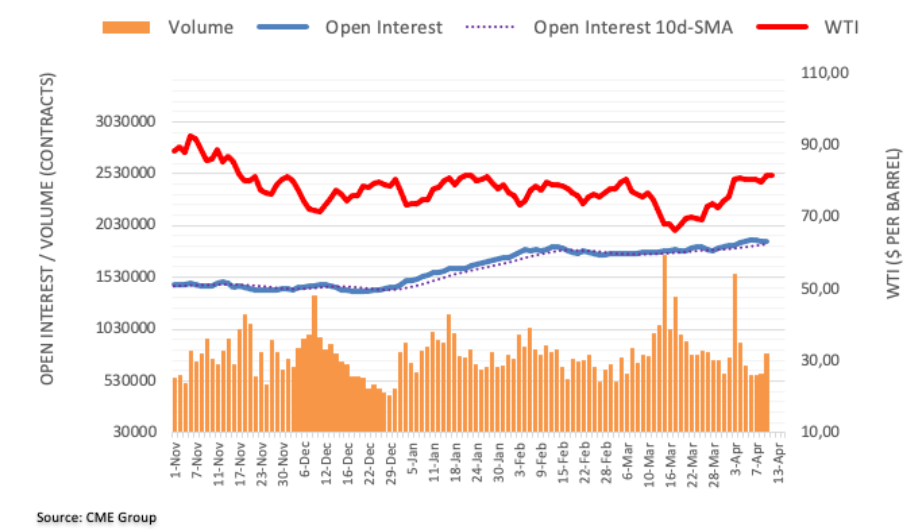

CME's latest crude oil trading data

Open interest rose by just 30 contracts after a two-day losing streak on Tuesday, according to preliminary data on the crude futures market from CME Group. Likewise, volume increased for the second straight session, this time by roughly 184,400 contracts.

WTI prices maintained a positive tone on Tuesday, breaching the $81.00-per-barrel mark amid rising open interest and volume, opening the door for a continuation of the uptrend in the near term, with a near-term target of the 200-day moving average of about $83.26.

WTI Oil Price Technical Analysis

The confluence of the 200-period exponential moving average (EMA) and the downtrend line from December 2022 around $81.70-75 poses a challenge for the bulls.

Additionally, the near-overbought relative strength indicator (14) added strength to doubts about further WTI oil price gains.

However, the bullish MACD signal and the 100 index moving average founding around $78.15 for WTI oil last week weighed on the bears.

On the downside, even if WTI oil prices fall below $78.15, February's lows around $73.85 and $72.50 may test the bears before they take over the market.

At the same time, the daily closing of WTI oil price breaking through the resistance of $81.75 will not indicate that WTI oil price will rebound, because the highs in January 2023 and December last year around $82.70 and $83.30 respectively will become the resistance of WTI oil price rise.

With WTI breaking through $83.30, it is not ruled out that WTI will rise closer to $90.00 and then the November 2022 high around $92.95.

In general, WTI oil price bulls still dominate, but around $81.75 still constitutes a strong resistance for bulls.

WTI oil price daily chart

Trend: Further upside expected

JRFX shares news information and professional technical analysis on foreign exchange, spot gold or crude oil every trading day. Follow us so as not to miss the market focus of the day and grasp the trading market in time.

JRFX reminds you: the market is risky, and investment needs to be cautious. This article does not constitute personal investment advice. Please choose corresponding investment products according to your own financial and risk tolerance, and do a good job in corresponding risk control.

About JRFX

· 12 years of financial market experience, the choice of more than 4 million customers, one of the most respected foreign exchange brokers in the world

· Provide 50+ trading products, including foreign exchange, spot gold, crude oil, stocks, indices, cryptocurrencies, etc.

· Three trading accounts to meet the investment needs of different customers

· Zero commission, low spread, leverage up to 1:1000

· You can open an account with a minimum deposit of 100 US dollars only

Views: 74368

Likes: 0