WTI oil prices rebounded in early European trading after falling in the Asian market to set an intraday low of US$66.90, and are currently trading at US$68.58/barrel. Although the turmoil in the global banking industry, which has been delayed for more than a week, continues to suppress market confidence, some institutions believe that the banking crisis has little impact on demand. The world is still facing supply shortages in the first half of the year, and oil prices will have room to rise by US$5-10/barrel.

During this period, WTI oil prices took their signals from a rebound in the US dollar and a consolidation in US Treasury yields.

The U.S. dollar index (DXY) is trading near 103.35 for the first day of gains after three straight days of losses, as dollar bears consolidate. Bond yield trading remained subdued as Japanese markets were closed for a holiday to limit trading in Asian bonds. Notably, U.S. 10-year and two-year U.S. bond yields rebounded from their lowest levels since September 2022, which came out the day before.

Oil prices were boosted by risk-on sentiment, in stark contrast to news of U.S. bank deposit guarantees that posed a challenge to WTI crude oil trading.

Sources say U.S. policymakers are looking at ways to insure all bank deposits, joining the UBS-Credit Suisse deal.

Haitong Futures analyst said: "The recent oil price trend mainly depends on how to win the trust of investors in the macro situation. If the banking crisis does not spread further, market sentiment may stabilize, and oil prices will have a chance to recover."

But investment bank Goldman Sachs believes that the impact of the banking crisis on commodities is more supply than demand. Until June, the world will still face oil shortages, which will push oil prices higher, and oil prices will have room to rise by US$5-10/barrel.

It's also worth noting that US President Joe Biden's readiness to release the Strategic Petroleum Reserve if needed will boost crude output, and the lack of market risk-friendly news from China. It is worth noting that according to the latest energy demand forecast released by the Organization of the Petroleum Exporting Countries and Russia (referred to as OPEC + Organization) and the US Energy Information Administration, Saudi Arabia supports the OPEC + production reduction agreement and expects energy demand to increase in the next few years.

On top of that, the market's latest hawkish bet on the Fed and worries about aThe next focus will be on whether and by how much the Federal Reserve decides to raise interest rates after its two-day policy meeting ends this week. Market expectations for a Fed rate hike this month have fallen from 50 basis points to 25 basis points since the banking crisis began.

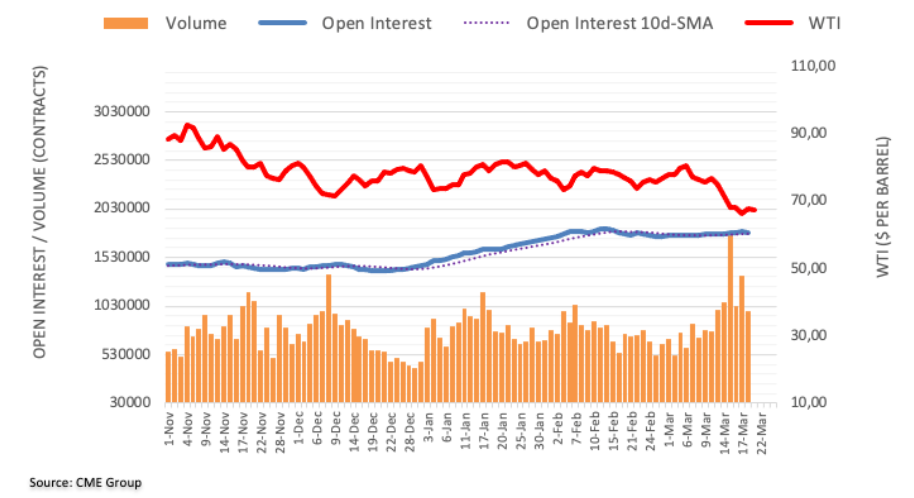

CME's latest crude oil trading data

Taking into account the latest data from the Chicago Mercantile Exchange Group crude oil futures market, the open interest of crude oil fell by about 3,800 contracts on Monday, ending the three-game winning streak. Volume fell by about 365,200 contracts, ending the previous day's increase.

The rebound in WTI crude oil prices on Monday came amid shrinking open interest and trading volume, suggesting that oil prices may not rise further for now. In this regard, the commodity appears to be opening the door for further declines in the short term and could retest the 2023 low of $64.40/bbl. banking crisis weighed on WTI oil prices ahead of the weekly release of industry inventory data from the American Petroleum Institute (API).

WTI Oil Price Technical Analysis

The relative strength indicator RSI oversold prompted WTI oil prices to rebound from multi-month lows.

In the market outlook, pay attention to the breakthrough of the Bollinger Line track 64.92-69.71 area.

In the short term, oil prices tend to rebound further, and it is expected that the Bollinger line will be further near 69.71.

Further strong resistance lies at the December 2022 low of $70.30.

The resistance of the oil price near the Bollinger line is relatively strong. If the resistance cannot be broken, the oil price will face the risk of returning to the downtrend in the future market.

The 10 moving average is supported around $66.53, further supported around $65.44, and the recent low is supported around $64.10.

If the support is broken, it means that oil prices have started a new round of decline.

JRFX shares news information and professional technical analysis on foreign exchange, spot gold or crude oil every trading day. Follow us so as not to miss the market focus of the day and grasp the trading market in time.

JRFX reminds you: the market is risky, and investment needs to be cautious. This article does not constitute personal investment advice. Please choose corresponding investment products according to your own financial and risk tolerance, and do a good job in corresponding risk control.

About JRFX

· 12 years of financial market experience, the choice of more than 4 million customers, one of the most respected foreign exchange brokers in the world

· Provide 50+ trading products, including foreign exchange, spot gold, crude oil, stocks, indices, cryptocurrencies, etc.

· Three trading accounts to meet the investment needs of different customers

· Zero commission, low spread, leverage up to 1:1000

· You can open an account with a minimum deposit of 100 US dollars only