01

Why do we trade gold?

Gold has been widely used all over the world as a tool for efficient indirect exchange. Mints produce standardized gold bullion coins, bars and other unites of fixed weight and purity for exchange purposes. In August 1971, France sold off its US Dollar reserves. The United States was under fiscal stress due to Vietnam War, and the President of USA to announce that USA would exit the Bretton Woods monetary. Since then, the gold market has blossomed because the gold has been driven by interest rates.

Today, gold is considered as a commodity. Investors look for alternative assets such as commodities, real estate, and foreign exchange for asset diversification. Gold prices are influenced by supply and demand just like other commodities. However, gold has few industrial usages compared with other metals, such as silver and platinum. Accordingly, the central to gold prices are saving and disposal, rather than consumption.

Gold is widely considered as a safe haven during times of market duress and geopolitical stress, a hedge against inflation, and an alternative to fiat currencies during periods of low or negative interest rates.

02

What are the key factors of gold price?

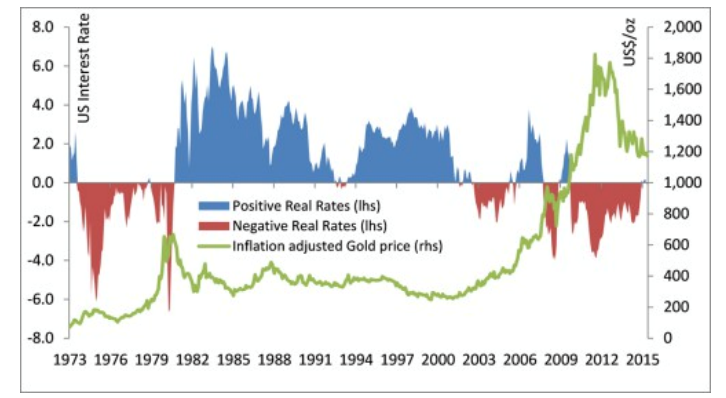

There are many factors that influence the price of gold, such as fluctuation between supply and demand. Moreover, there is a well-established correlation between gold price and real interest rate.

Weak real interest rate usually is positive for gold price

(source from Blomberg)

The graph shows a strong inverse relationship between the price of gold and real interest rate: when real interest rate raises, the gold price drops and vice versa.

A drop in real interest rates means there is less capacity for bonds to maintain the purchasing power over time. The interest in alternative assets (like gold) intended to preserve this purchasing power – even if they don't bear interest– is thus reinforced, and financial demand eases. And vice versa. This correlation is not a coincidence, and it is, thus, likely that the two curves actuality show two sides of the same phenomenon.

03

What are main types of gold to trade?

With the progress of the times, gold investment methods are becoming more and more diversified. There are several types of gold that investors can trade:

#1 Physical Gold

Physical gold is a relatively primitive investment method, including gold bars, gold coins, jewelry, etc. It is only for the purpose of maintaining value and anti-inflation, not investing.

#2 Paper Gold

Paper gold is a kind of personal voucher type gold launched by the four major domestic banks, such as China, agriculture, industry, and construction. Investors buy and sell "virtual" gold on the books at the quoted price of the bank. By grasping the trend of international gold prices, they can buy low and sell high.

Taking the fluctuation difference of the gold price, no physical gold withdrawal and delivery will occur.

#3 Spot Gold

Spot gold is an international investment product. Gold companies establish trading platforms and conduct online trading with market dealers in the form of leverage ratios to form investment and financial management projects.

#4 Gold Futures

Gold futures refer to futures contracts that take the gold price at a certain point in the future in the international gold market as the subject of the transaction. The profit and loss of investors buying and selling gold futures is measured by the gold price difference between entering the market and exiting the market. The contract expires The latter is physical delivery.

#5 Gold Option

The gold option is a price in the future agreed by the buyer and the seller, and they have the right to purchase a certain amount of the target, but not the obligation. If price movements are beneficial to option traders, they will exercise their rights to make a profit. If the price trend is unfavorable, the right to buy is waived, and the only loss is the cost of buying the option at that time.

04

Where to trade gold?

Due to the global nature of the gold market, gold price always fluctuates– even when other markets are closed. You can follow gold price in real-time, review pivot points, and follow the latest forecasts from JRFX. You will also find trading guides, and an economic calendar of events that would impact gold price from us.

JRFX is a leading provider of contract for Difference (CFDs), delivering trading facilities on shares, forex, commodities, and metals alongside to direct access world electronic trading market by innovative trading technology.

Risk Warning: The above content is for reference only, and does not represent JRFX’s position. JRFX does not assume any form of loss caused by any trading carried out in accordance with this article. Please consult your financial planner for your investment portfolios and manage your own risk.

JRFX is an online CFD broker providing more than 50 products for Forex, metals and commodities. Open a trading account within a minute. Deposit 100USD and download our MT4 trading platform now! We have unprecedented promotion program!

|

|

|

|

Views: 1648

Likes: 0